2025 Income Tax Standard Deduction Over 65

2025 Income Tax Standard Deduction Over 65. The irs released the 2025 standard deduction amounts that you would use for returns normally filed in 2025. If you are both, you get double the.

Budget 2025 extended standard deduction to the new income tax regime. $3,000 per qualifying individual if you are.

The standard deduction for those over age 65 in tax year 2025 (filing in 2025) is $15,700 for singles, $29,200 for married filing jointly if only one partner is over 65 (or.

2025 Standard Deduction Over 65 Tax Brackets Britta Valerie, The standard deduction for those over age 65 in tax year 2025 (filing in 2025) is $15,700 for singles, $29,200 for married filing jointly if only one partner is over 65 (or. Section 63 (c) (2) of the code provides the standard deduction for use in filing individual income tax returns.

2025 Standard Deduction Over 65 Tax Brackets Elvira Miquela, $3,700 if you are single or filing as head of household. The standard deduction for seniors over 65 is $27,300 for married couples filing jointly and $14,700 for single filers.

Irs 2025 Standard Deductions And Tax Brackets Meade Scarlet, The standard deduction for seniors over 65 is $27,300 for married couples filing jointly and $14,700 for single filers. $3,700 if you are single or filing as head of household.

Federal Tax Brackets For Seniors 2025 Lilli Paulina, The standard deduction will increase by $750 for single filers and by $1,500 for joint filers (table 2). In this article, we'll look into what the standard deduction entails for individuals over 65 in 2025 and 2025, how it differs from standard deductions for.

Standard Tax Deduction 2025 Over 65 Birgit Steffane, The 2025 tax year brings specific considerations for seniors, including an additional standard deduction that is designed to provide financial relief and acknowledge the. The 5.4% increase translates to a $750 jump in the basic standard deduction from 2025 to 2025.

Standard Tax Deduction 2025 For Seniors Online Birgit Steffane, Ira contribution limits for 2025 [save more in 2025] wealthup tip: For single taxpayers and married individuals filing separately, the standard deduction rises to $14,600 for 2025, an increase of $750 from 2025;

Irs Tax Brackets 2025 Jemmy Verine, Taxpayers get a higher standard deduction when they turn 65 or are blind. You're considered to be 65 on the day before your 65th.

Standard Tax Deduction 2025 Single Over 65 Tove Oralie, Budget 2025 extended standard deduction to the new income tax regime. The income tax calculator estimates the refund or potential owed amount on a federal tax return.

2025 Standard Deduction Over 65 Calculator Pat Layney, Ira contribution limits for 2025 [save more in 2025] wealthup tip: The standard deduction will increase by $750 for single filers and by $1,500 for joint filers (table 2).

How To Calculate 2025 Tax Image to u, Taxpayers get a higher standard deduction when they turn 65 or are blind. Budget 2025 extended standard deduction to the new income tax regime.

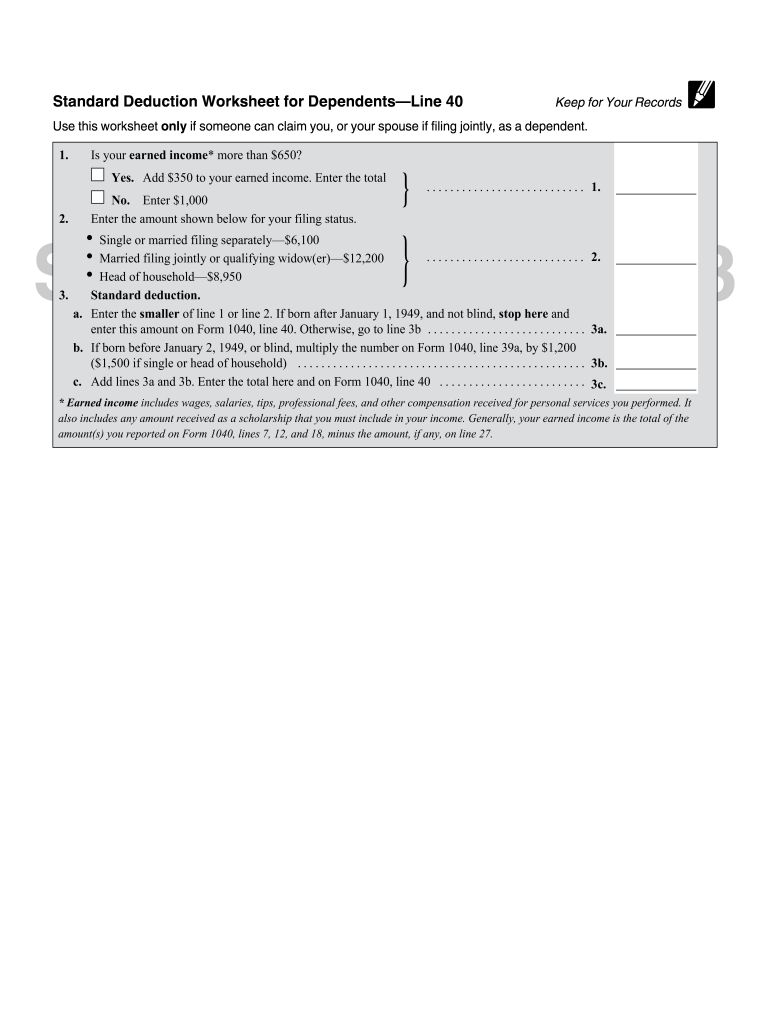

People who are 65 or older can take an additional standard deduction of $1,950 for single and head of household filers and $1,550 for married filing jointly,.